In the high-stakes environment of global energy, the difference between record-breaking production and catastrophic loss often hinges on a single component. As the industry moves through 2026, spare parts have shifted from a procurement line item to a pillar of national and corporate resilience. Aging infrastructure, geopolitical volatility, and material scarcity have exposed a fragile supply chain model built for a world that no longer exists. With digital transformation in Oil & Gas projected to reach $56.4 billion by 2029 (14.5% CAGR), operators now face a strategic inflection point: Continue managing physical inventory or transition to a decentralized, data-driven supply chain designed for resilience.

The Critical Role of the Overlooked Supply Chain

While industry attention often centers on exploration and decarbonization, the mechanical integrity of existing assets continues to be the primary driver of operational ROI. In 2026, the importance of spare parts is no longer theoretical it is defined by direct financial exposure, safety risk, and regulatory consequence.

-

Unplanned downtime costs:

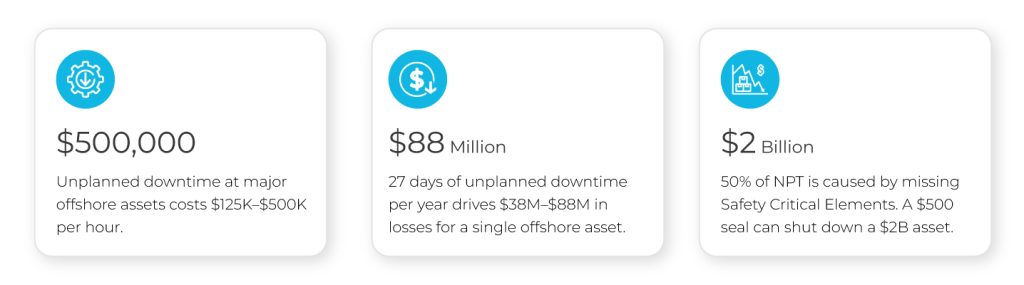

Industry benchmarks from 2025–2026 show that downtime at mid-to-large offshore platforms and high-capacity refineries costs between $125,000 and $500,000 per hour. -

Annual operational losses:

The average offshore platform experiences approximately 27 days of unplanned downtime per year, resulting in $38 million to $88 million in losses per asset.

Safety and compliance exposure:

More than 50% of Non-Productive Time (NPT) in high-pressure environments is attributed to the absence of Safety Critical Elements (SCEs). In practical terms, a missing $500 seal can legally and physically shut down a $2 billion asset.

The Adversarial Landscape: Why the Old Model Is Failing

The traditional Just-in-Time (JIT) philosophy, built on the premise of a frictionless global market, has buckled under mid-2020s volatility.

The Lead-Time Gap

Trade fragmentation and export restrictions on high-performance alloys have created a massive disconnect.

-

Components such as actuators and specialized sensors that had an 8-week lead time in 2023 now face wait times of 30 to 50 weeks

-

This disruption has driven a 91% shift in supply chain strategies toward Just-in-Case stockpiling or localized, on-demand manufacturing

Physical and Geopolitical Chokepoints

Maritime routes essential for heavy oil and gas equipment are under unprecedented pressure:

-

Strait of Malacca:

The conduit for 24 million barrels per day (bpd) of oil and gas, and a primary bottleneck for Asian-manufactured electronics and specialized steel reaching Western markets -

Bab el-Mandeb and Red Sea:

Ongoing security flashpoints have forced permanent rerouting around the Cape of Good Hope, adding 8 to 14 days to transit times and driving insurance premiums up by as much as 300% in certain zones

Bottlenecks: Technical and Material Scarcity

Two structural constraints are increasingly shaping operational risk across the industry.

The “Silver Tsunami” is already underway. Over 50% of the industry’s specialized workforce is reaching retirement age between 2025 and 2030. This growing loss of tribal knowledge makes maintaining legacy assets, many of which are 25+ years old, a high-risk endeavor.

At the same time, material competition is intensifying. Oil and gas is now competing directly with the EV and Aerospace sectors for a shrinking supply of Nickel, Titanium, and specialized polymers. Supply chain environmental risks linked to these materials are projected to cost the industry $120 billion in 2026 alone.

Strategic Outlook (2026–2029): The Digital Pivot

The next three years will mark a fundamental transition from physical stockpiling to Distributed Manufacturing models.

The Rise of Digital Warehousing

The most resilient companies are shifting inventory from physical warehouses to the cloud.

-

Asset-light operations:

Spare parts stored as Digital Twins and certified CAD files enable immediate global transmission -

Engineering data remains accessible regardless of OEM availability or geographic constraints

On-Demand Manufacturing

By moving bits, not atoms, digital files can be sent directly to local Advanced Manufacturing Centers.

-

Lead times reduced from months to days

-

Physical inventory holdings expected to decrease by 15–20% across the sector

Localization and “Friend-Shoring”

A major shift toward Regional Manufacturing Hubs is underway.

-

Companies are prioritizing localized production in the GCC, North America, and India

-

Critical components are increasingly produced within stable, politically aligned corridors

Resilience as a Competitive Advantage

In the 2026–2029 window, operational excellence is synonymous with supply chain resilience. The companies that thrive will be those that transition from “owning the hardware” to “owning the data” to produce it.

Frequently Asked Questions

Why is spare parts supply chain resilience critical for oil & gas operations?

Spare parts supply chain resilience is critical because a single unavailable component can cause unplanned downtime, production losses, safety risks, and compliance issues. As lead times increase and OEM support declines, oil & gas operators need resilient systems that ensure parts availability when failures occur.

What is digital warehousing in the oil & gas industry?

Digital warehousing is the practice of converting physical spare parts into secure digital assets such as certified CAD files and digital twins. Instead of storing parts on shelves, companies store production-ready data that can be transmitted instantly and manufactured on demand.

How does on-demand manufacturing reduce downtime risk?

On-demand manufacturing allows spare parts to be produced locally at the point of need using approved digital files. This eliminates long international lead times, reduces dependency on global suppliers, and enables faster recovery when critical equipment fails.

What problems does the traditional Just-in-Time (JIT) supply model create today?

The traditional JIT model relies on predictable logistics and supplier availability, which no longer exist. Geopolitical disruption, long lead times, and material shortages have made JIT unreliable for critical spares, exposing operations to extended downtime and higher risk.

How does spare parts digitization improve long-term operational resilience?

Spare parts digitization improves resilience by making parts traceable, accessible, and production-ready at any time. Digitized inventories reduce physical stock dependency, lower inventory costs, and enable faster, localized manufacturing across regions.